Business

Tips for Nonprofit & Business Leaders Launching Community Projects

Identify community needs through engaging locals, researching policies, and finding partners for a successful construction project. Form a dedicated team, allocating roles and responsibilities to ensure efficient project progression. Invest in high-quality rigging equipment, like web slings, wire ropes, and hoists, for safety and efficiency.…

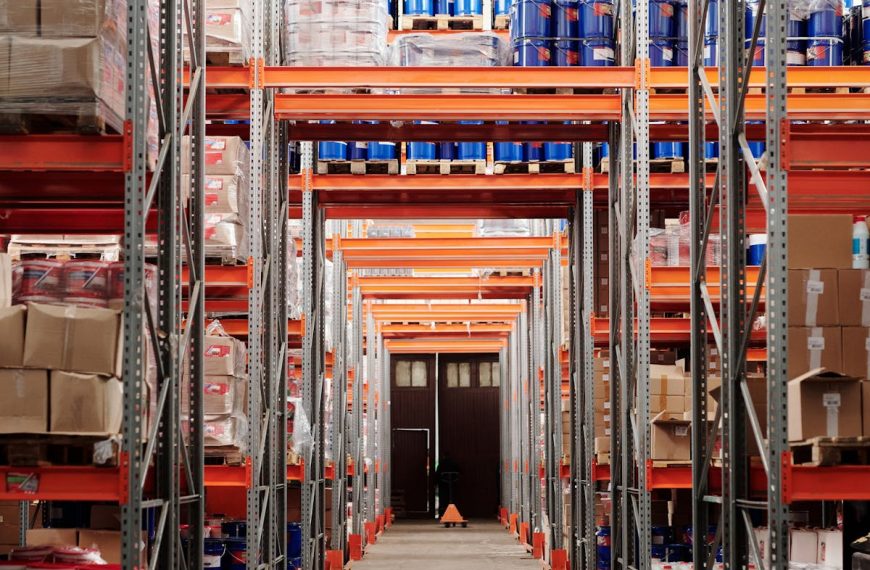

Improving Reverse Logistics Operations in Singapore’s Retail Industry

Invest in automated technology and equipment to streamline returns and improve inventory management. Enhance communication with customers through clear return policies and responsive support channels. Regularly train retail staff in return procedures and customer service for better service delivery. Partner with specialized logistics providers for…

latest posts

Tips for Nonprofit & Business Leaders Launching Community Projects

Identify community needs through engaging locals, researching policies, and finding partners for a successful construction project. Form a dedicated team, allocating roles and responsibilities to ensure efficient project progression. Invest in high-quality rigging equipment, like web slings, wire ropes, and hoists, for safety and efficiency. Through careful planning, financial management, and promotion, community construction projects…

International Growth

5 Best Tips for Scaling Up Your Small Business in a Global Market

Market research is essential for understanding cultural nuances and regulatory conditions in new international markets. Strategic partnerships can help with logistics and provide local market expertise, facilitating easier entry. Digital marketing, tailored for each locale’s preferences, increases brand visibility and fosters global engagement. Adopting advanced…

Home Sweet Transformation: Rethinking Your Space for Fun and Adventure

Family-centric design and multifunctional zones can transform your home into a tailored, functional space. A clutter-free, organized home enhances the quality of life, facilitated by effective storage solutions. Infuse fun and adventure by creating creative play areas, tackling DIY projects, and establishing entertainment zones. Transform…

How to Effectively Maintain & Improve Your Medical Spa

Staff investment aids in improving service quality and fostering loyalty, including training and performance incentives. Digital marketing strategies, guided by trusted experts, can significantly enhance your medical spa’s online visibility. A positive customer experience hinges on effective communication, a clean environment, and keeping up with…

Business Legalities

Navigating the Legalities in Real Estate Purchases To Ensure a Smooth Transaction

Hiring a reliable real estate lawyer is essential in navigating the legalities of property transactions effectively. A thorough home inspection can reveal potential issues, aiding in negotiations with the seller. Conducting a title search ensures the seller’s legal ownership and reveals any outstanding charges against…

Make Noise for Business: What to Consider Doing

Establishing a distinct brand and engaging content is crucial for increasing business visibility. Knowing your audience aids in crafting content and stories that resonate and evoke emotional connections. Interaction with the audience through social media, email marketing, and live events nurtures relationships. Measuring content engagement…

Technology

How to Effectively Manage a Hospital

Investing in technology can improve healthcare delivery and reduce costs. Prioritizing quality and safety is crucial for a hospital’s reputation. Advanced hospital UV sanitizers are essential for preventing the spread of infections. Engaging with the community can help ensure culturally appropriate care. Improving staff morale…

The Critical Role of Local Law Firms in Your Community

Local law firms offer essential services to businesses, communities, and individuals, promoting justice and legal compliance. They provide pro bono services, which enhance access to justice, especially for vulnerable individuals or organizations. Law firms often contribute to the community through charitable and social activities, fostering…

Simplifying Your Commutes for Easy Travel using SMRT App

The SMRT App provides real-time updates and timetables for train departure/arrival times, making navigating Singapore’s congested public transportation system easier. It features a fare calculator and journey planner that help users save time, energy, and money when commuting. The ‘Save a Route’ option allows travelers…